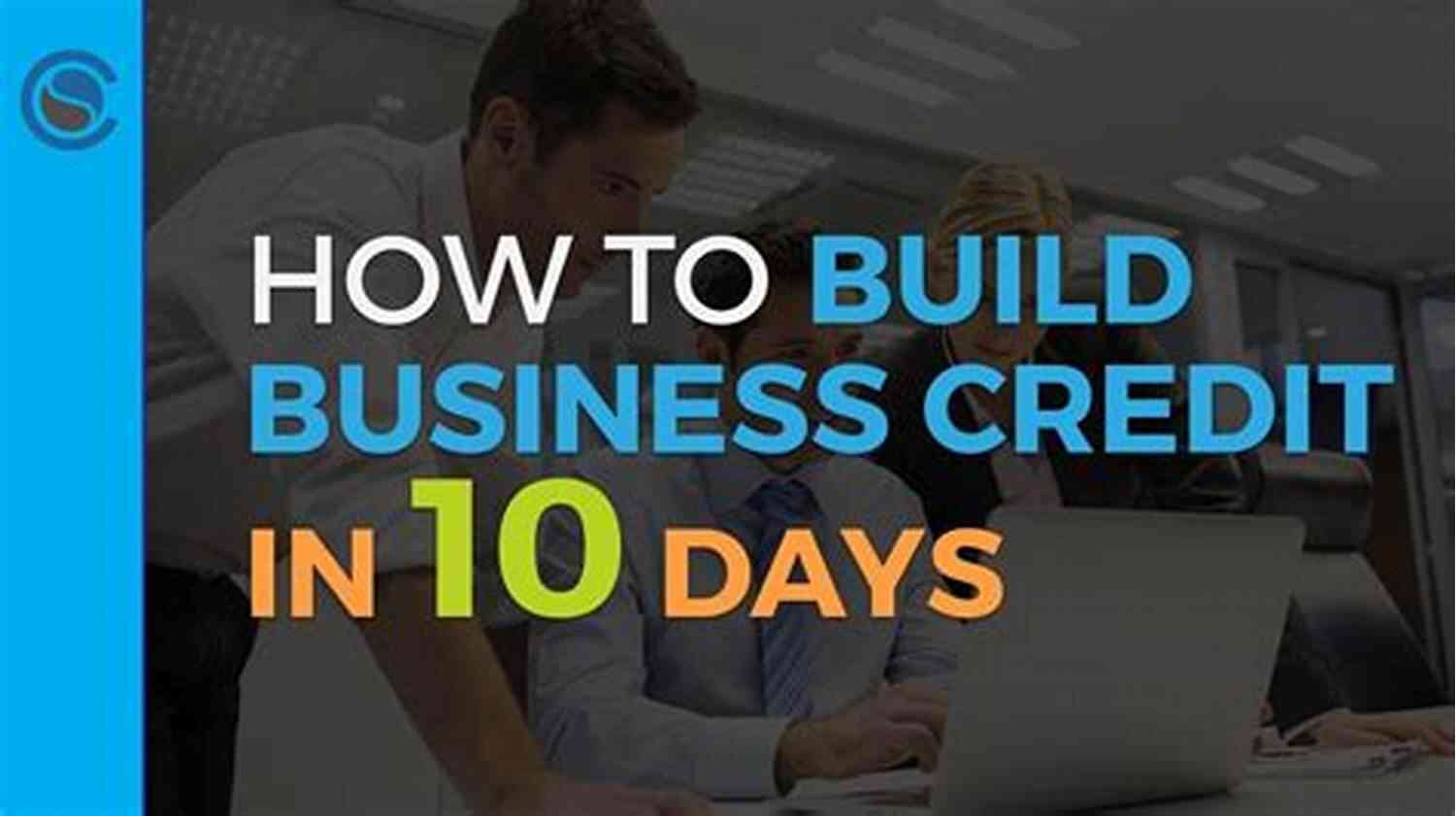

Building Business Credit From Scratch

Starting a business requires a lot of careful planning and strategic thinking. It is not just about having a great product or service, but also about managing finances effectively. One crucial aspect of financial management is building business credit. Building business credit from scratch can be challenging, but it is essential for the long-term success and growth of your business. In this article, we will explore the steps you need to take to establish and strengthen your business credit.

Understanding Business Credit

Business credit is similar to personal credit but applies specifically to your business. It is a measure of your business's ability to repay loans and meet financial obligations. Building strong business credit allows you to access better financing options, negotiate favorable terms with suppliers, and protect your personal assets from business liabilities. It essentially establishes your business's reputation and credibility in the eyes of lenders, suppliers, and other business partners.

Step 1: Establish Your Business Entity

The first step in building business credit is to establish your business as a separate legal entity. Registering your business as a corporation or LLC (Limited Liability Company) creates a clear distinction between your personal and business finances. This separation is crucial for protecting your personal assets and ensuring that your business can build its credit independently.

5 out of 5

| Language | : | English |

| File size | : | 416 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 12 pages |

| Lending | : | Enabled |

Step 2: Obtain an Employer Identification Number (EIN)

An Employer Identification Number (EIN) is a unique nine-digit number provided by the IRS. It is essentially the social security number for your business. Obtaining an EIN is necessary to open business bank accounts, apply for business licenses, and file tax returns. It also helps establish your business's identity and credibility, which are important factors in building business credit.

Step 3: Open a Business Bank Account

Separating your personal and business finances is crucial for building business credit. Opening a business bank account allows you to keep track of your business's income and expenses separately. It also helps establish a banking relationship, which is essential for future credit applications. Choose a bank that offers business-specific services and be sure to maintain a positive balance and manage your finances responsibly.

Step 4: Obtain Trade Credit

Trade credit is a form of credit extended by suppliers and vendors. It allows you to purchase goods or services and pay for them at a later date, typically within 30 to 90 days. Establishing trade credit is an effective way to build your business credit history. Start by working with suppliers who are willing to extend credit to your business. Make payments on time and strive for longer payment terms as your business credit improves.

Step 5: Apply for a Business Credit Card

A business credit card is another useful tool for building business credit. Look for a card specifically designed for small businesses with favorable terms and rewards that align with your business needs. Use the card responsibly, making timely payments and keeping the credit utilization ratio low. Regularly review your credit card statements and dispute any unauthorized charges to maintain a clean credit history.

Step 6: Establish a Positive Payment History

Paying your bills on time is crucial for building business credit. Late payments or defaults can have a significant negative impact on your credit score. Set up automated reminders or consider using accounting software to stay on top of your payments. Make sure to pay all your business obligations, including loans, credit cards, and trade credit, promptly. Consistently demonstrating your ability to manage credit responsibly will help establish a positive payment history and improve your business credit score.

Step 7: Monitor and Review Your Credit Reports

Regularly monitoring your business credit reports is essential for identifying any errors or inaccuracies. You can request a free copy of your credit report from major credit bureaus like Experian, Equifax, and TransUnion. Review the reports carefully and dispute any incorrect information. Monitoring your credit reports also allows you to track your progress and take corrective actions if needed.

Building business credit from scratch is a critical aspect of running a successful business. It requires careful planning, financial management, and responsible credit behavior. By following the steps outlined in this article, you can establish a strong business credit profile, gain access to better financing options, and pave the way for the future growth and success of your business. Remember, building business credit is a long-term process, so be patient, stay vigilant, and watch your business credit soar!

Related Articles:

- Securing Small Business Loans: A Comprehensive Guide

- Effective Marketing Strategies for Growing Your Business

5 out of 5

| Language | : | English |

| File size | : | 416 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 12 pages |

| Lending | : | Enabled |

This book goes into detail on how to…..

- Create a business plan

- Getting a virtual business address

- How to obtain a business license

- Where to get your free EIN

- How to set up your business structure

- How to get your free DUNS number

- How to get a business checking account

- How to register your business

- Over 60 NET 30 accounts to help build credit are listed in this book

- Tax credits

- Set up AirBnBs in your business name

- Purchase vehicles in business name

- Which business credit cards are available

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Andres CarterSave Thousands On Your Medicare Supplement Medigap: The Guide to Finding the...

Andres CarterSave Thousands On Your Medicare Supplement Medigap: The Guide to Finding the... Gordon CoxFollow ·16.6k

Gordon CoxFollow ·16.6k Jorge AmadoFollow ·7.7k

Jorge AmadoFollow ·7.7k Quincy WardFollow ·15.4k

Quincy WardFollow ·15.4k Avery SimmonsFollow ·19.8k

Avery SimmonsFollow ·19.8k Theo CoxFollow ·17.3k

Theo CoxFollow ·17.3k Edgar HayesFollow ·18.4k

Edgar HayesFollow ·18.4k Dashawn HayesFollow ·3.9k

Dashawn HayesFollow ·3.9k Dustin RichardsonFollow ·12.6k

Dustin RichardsonFollow ·12.6k

Fletcher Mitchell

Fletcher MitchellPoems About Lovers, Family, Friends And Home -...

Poetry has always been a powerful...

Darius Cox

Darius CoxThe Friendship Poems Of Rumi: Discover the Timeless...

Friendship is a sacred bond that...

Gordon Cox

Gordon CoxLet Go Of Who You Think You're Supposed To Be And Embrace...

Have you ever felt like you were living a...

Truman Capote

Truman CapoteTreasure Of Pearls Celebrating Life Lived In Poetry:...

Life is a wondrous journey, filled with...

Jaime Mitchell

Jaime MitchellThe World Of Otome Games Is Tough For Mobs: An Epic...

Welcome to the magnificent realm of...

Jules Verne

Jules VerneMiss You My Darling - The Powerful Emotions of Longing

Do you ever find yourself longing for...

F. Scott Fitzgerald

F. Scott FitzgeraldThe Iliad of Homer Illustrated Edition: A Timeless Epic...

The Iliad of Homer is a captivating tale...

Gene Powell

Gene PowellWho Would Search For Pearls Must Dive Below

The Ultimate...

Bret Mitchell

Bret MitchellHow To Create Animated And Professional Videos Using...

Apple Keynote is not just limited to...

Caleb Long

Caleb LongThe Incredible World of Aromatic Herbs: Unveiling their...

Are you looking to add a burst of flavor...

Charlie Scott

Charlie ScottCry Baby Mystic Free Verse Editions: Embracing Emotions...

Poetry has long been a means of...

Kendall Ward

Kendall WardThe Ultimate Action Guide For Resolving Conflict: Expert...

Conflict is an inevitable part...

5 out of 5

| Language | : | English |

| File size | : | 416 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 12 pages |

| Lending | : | Enabled |